Address

56 S. LaSalle Ave. Ste.106

Aurora, IL 60505

Get in touch

MBIS data reveals muni price trends through times of crisis

We at MBIS are extremely pleased to be a data supplier for the University of Chicago Center for Municipal Finance.

MBIS bond data powers the Center's

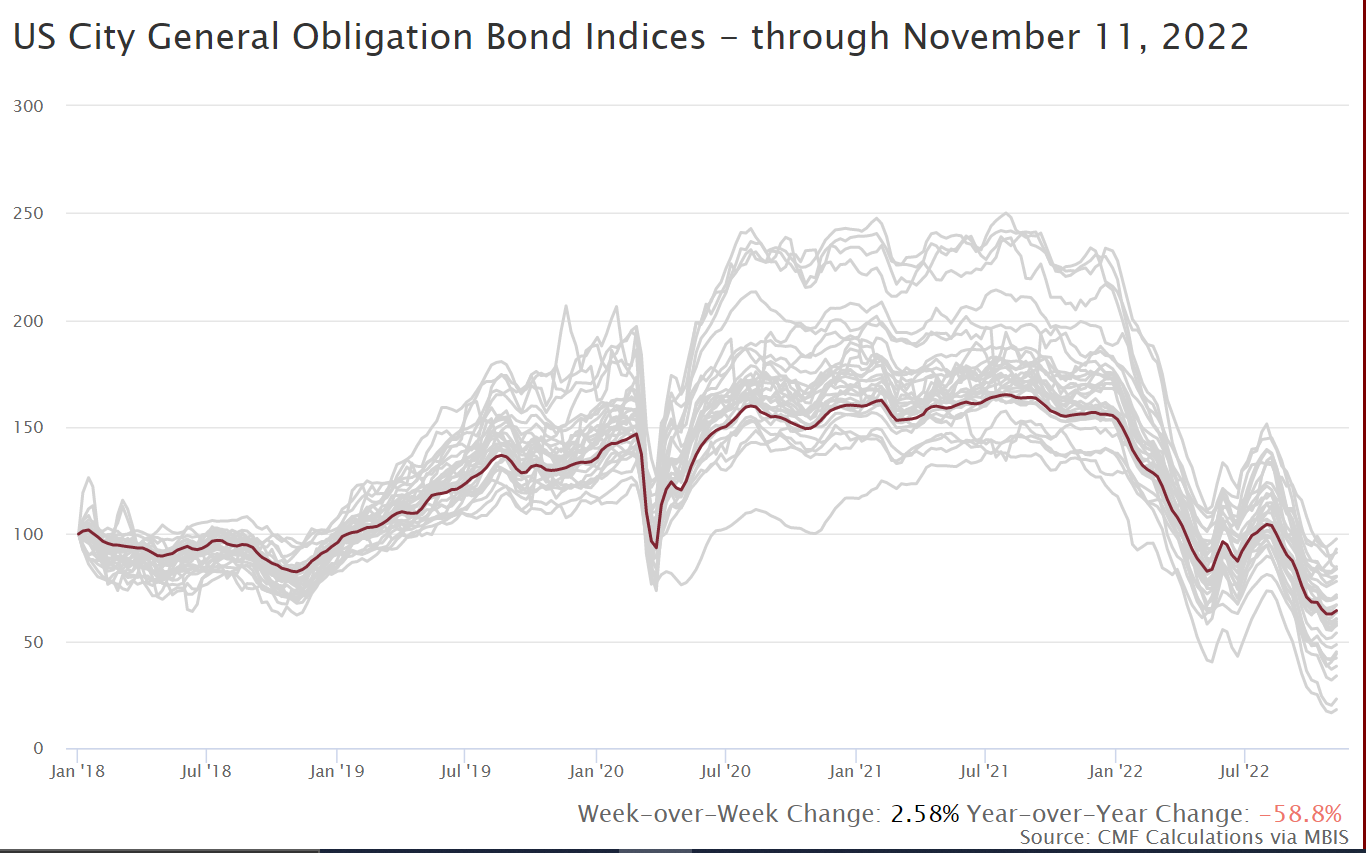

Indices for general obligation bonds for cities, counties, and school districts, providing a robust set of characteristics and prices that track bids, offers, and trades on a real-time basis. The following graph of US City General obligation bonds shows a base start of 100 starting on January 2, 2018:

As you can see, there are quite a variety of price moves among the US large cities, from the arrival of Covid concerns in the spring of 2020 where there was a sizable drop in prices, to the steady recovery through 2021. Then the extreme hit to bond prices as rates rose from the Federal Reserve raising rates in large increments of 75 basis points during 2022. Inflation threats, Ukraine, rising energy prices all have hit the economy in both equities and bonds.

The next graph of counties shows similar price movements for the same reasons.

The final graph of school districts also tells the same story.

Our data is uniquely suited for revealing these sorts of trends. Our comprehensive universe of pre-trade bid and offer data gives a powerful tool for fine-grained analysis to both academic and market users alike.

MBIS data is available via the MBIS.com website, managed by Securities Quote Xchange, SQX.com